Hydrogen could be great... but actually, right now ... it's really REALLY BAD

Two-faced Hydrogen

Hydrogen is a futuristic non-polluting wonder-fuel. It can be made from electricity, and turned back into electricity with no harmful emissions. It's a fuel, it's a gas, and at first glance, it looks ideal to replace fossil fuels in a whole bunch of applications. Until you look a little closer.

(1) Hydrogen is highly polluting to manufacture (at the moment). 96% of the world's hydrogen is still made from coal or natural gas, and causes 2% of the world's CO2 emissions.

(2) Hydrogen is much costlier than the fuels it might replace

Hydrogen for energy costs more than double the price of coal or gas it's made from, because the process wastes half of the energy, with capital costs of plant and processing on top of that.

(3) Hydrogen is very difficult (expensive) to store and distribute safely

Hydrogen is hard to handle, and contains only 1/3 of the energy of a similar volume of natural gas. Its tiny molecules leak even more readily than natural gas. Worse, the molecules make the network more fragile by dissolving into metals, causing metal pipes and joints to become more brittle.

"But" ... I hear you say ... "What about Electrolysis?"

Yes, the long-awaited zero-pollution version, made from just water by electrolysis, is now being scaled up all over the world. Yet even this ‘green’ hydrogen hides a dirty secret: the electricity comes inefficiently from gas (or worse), causing

even higher emissions

Electrolysis is emission free, but its high electricity demand is extremely polluting,

as gas power stations have to be fired up to supply it, even when renewables supply 99% of the grid's power:

The whole process uses 50% more gas than the chemical process (steam methane reformation), and produces 50% more CO2.

- 50% higher.

The whole process uses 50% more gas than the chemical process (steam methane reformation), and produces 50% more CO2.

- 50% higher.

Hydrogen from electrolysis is 50% dirtier than from fossil fuels, if the grid needs to burn gas to power it.

But when the grid has spare electricity - from too much wind and solar - suddenly electrolysis becomes emission-free, and a valuable resource to soak up the surplus power.

Hydrogen Fact file

Hydrogen today

The world produces 70m tonnes of hydrogen each year, mostly for oil refining or to make fertiliser.

About 2% (830m tonnes) of the world's CO2 emissions come from making hydrogen.

96% of hydrogen is made from either

methane

Hydrogen made from natural gas by Steam Methane Reformation (SMR).

(1) Cook methane in super-heated steam to produce hydrogen (H2) and carbon monoxide (CO):

(2) CO then reacts with more steam to produce CO2 and more hydrogen

(2) CO then reacts with more steam to produce CO2 and more hydrogen

(3) Separate hydrogen from reaction gases by 'pressure swing adsorption'.

(4) Waste includes unburned gases fed back into gas burners fuelling the reaction

Note: We show the two different CO2 sources separately, but in reality, the reaction CO2 remains in the waste stream fed back to the gas burners, except in plants that employ 'carbon capture'.

or

coal

Hydrogen made by Coal Gasification (CG) process is conventionally labelled 'black' hydrogen.

The process is very similar to SMR, but more polluting:

(1) Cook pulverised coal in super-heated steam to produce hydrogen & carbon monoxide.

(2) Carbon monoxide then reacts with more steam to produce CO2 and more hydrogen

(3) Hydrogen and CO2 are separated by 'pressure swing adsorption' process.

(4) The whole reaction is super-heated from outside by coal burners

Much costlier and harder than natural gas to produce,

store

Hydrogen storage needs much higher pressure or much bigger tanks for the same energy as natural gas. It is much more prone to leakage, and also makes metal more brittle. However, it can be stored at scale like natural gas, in depleted gas fields such as the Rough storage facility which is now being converted to store hydrogen.

and distribute

Hydrogen costs around £1.50-£3 per kg, or £3-£6 if it's made by electrolysis

Hydrogen tomorrow

Main use of hydrogen likely to be for long-term storage of renewable energy for power.

Other uses could include manufacture of materials (eg steel, glass, concrete...)

It might even become affordable as a feedstock to make fuels for shipping and/or aviation

Hydrogen will remain too complicated and costly to be useful for transport or domestic sectors.

How dirty is hydrogen?

Hydrogen is conventionally described by different colours that denote how it is made:

12t |

Grey |

Typically produces 9-14 tonnes of CO2 for every tonne of hydrogen produced. Variability depends upon the conversion and capture rate of the hydrogen produced, and overall thermal efficiency of the plant:

Three quarters

of the world's hydrogen is made this way. Most of the rest is made using coal (coal gasification) |

15t |

Black |

Similar to the SMR process,

coal is cooked in steam to make carbon monoxide and hydrogen, which reacts with more steam to make hydrogen and carbon dioxide.

C + H2O -> CO + H2 -> CO2 + H2 + H2

H2O H2O

Hydrogen from coal (CG process) typically produces 50% more carbon dioxide hydrogen from natural gas (SMR process), as well as high methane emissions from coal mines. CG accounts for about a quarter of all hydrogen produced. The rest is made mostly by SMR process (see 'Grey' hydrogen) |

6t |

Blue |

Whilst carbon capture reduces direct CO2 emissions, 15-35% still escapes capture, and electricity to power the process creates new emissions of its own. (It is quite complicated! ...) :

This full version of 'blue' hydrogen, capturing both reaction and flue gases, has never yet been attempted.

Existing 'blue' plants

Hydrogen production with carbon capture (of reaction gases only)

Quest, Alberta

Agrium, Alberta

Air Products, Texas

Koch, Texas

Coffeyville, Kansas

only attempt partial capture, solely from the spent reaction gases. Capturing CO2 from the flue gases is much less effective, because it is much more dilute.

Data from two power stations that captured flue emissions (Boundary Dam and Petra Nova) showed a much lower capture rate (of 65%) and greater energy needs causing 0.39kg of CO2 for every kg CO2 captured.

|

16t |

Green1 |

The process is emission free, but its electricity demands are highly polluting, as gas power stations have to be fired up to supply it.

fugitive emissions (gas leaks) from gas wells, extraction processes and transportation network typically amount to 3.5% of end product, with 20-year global warming potential 86 times more potent than CO2.

|

zero |

Green2 |

Electrolysis is only emission-free when the grid is carbon-free. Otherwise, it creates demand that has to be met by burning more carbon.

|

zero |

White |

Naturally occurring hydrogen constantly produced by geological processes deep within the earth could potentially supply more hydrogen than we could ever need, if only we can get it out and channel it to useful work. There's a big story going around the internet about a discovery in Mali, with 30 wells providing enough hydrogen to "provide electricity for the village". Despite the micro scale, geologists believe that the find is actually huge. Other discoveries in Australia, the USA and Spain have helped raise hopes that there may be hydrogen all over the world, and there might be enough to supply all our energy needs for centuries. The most promising, in Lorraine, France, is estimated to contain up to 250 million tonnes of hydrogen. The many challenges include proving that the hydrogen is recoverable, and getting it to where it can be useful.

However, all the

excitement

Large discoveries of natural hydrogen

Mali - Bourakébougou field (5mt?)

- 30 productive wells drilled by Hydroma

& Chapman Petroleum, but have struggled to commercialise it.

Spain - Monzon field, Aragon (1.1 mt)- Helios Aragon planning to begin production in 2025

US - Koloma - backed by Bill Gates, exploring US mid-continent rift valley, along with other start ups (HyTerra, Natural Hydrogen)

South Australia - six startups, including Gold Hydrogen in Yorke Peninsula & Kangaroo Island (1.3 mt?), with a seven-well drilling programme costing A$30M

France - Engie, University of Pau and others investigating huge discovery in Lorraine, of potentially 46mt

might be premature, as it is likely to be harder to extract and transport than natural gas, and contain less energy (by volume). The significance of that is that it pushes the cost up, potentially making it too expensive compared to natural gas . . . or 'grey' hydrogen.

|

NOTE - carbon emissions from each technology can be much higher in practice, depending upon the thermal efficiency of the plant, and the proportion of hydrogen harvested from the reaction.

* All of our figures ignore

'fugitive emissions'

Fugitive methane emissions are a major driver of global warming

Methane emissions are responsible for up to a quarter of global temperature rises. 37% of these leak from activities of fossil fuel industries. Two other main sources are agriculture (40%) and waste (20%).

There's much less methane in the air than CO2, but its global warming potential

(GWP)

GWP (Global Warming Potential)

GWP measures the warming effect of a gas compared to CO2. For example, methane's GWP falls over time, as the gas quickly decomposes over decades:

- Effect over 0 years (GWP0) = 120 . . . (i.e., 120x more warming than CO2)

- Effect over 20 years (GWP20) = 83

- Effect over 100 years (GWP100) = 20

is 120 times stronger before the gas quickly decomposes over decades.

Energy industry emissions come mainly from fracking and flaring; from wells, pipework or valves; from incomplete combustion; and from coal mining.

The worst discharges come from oil or coal operations where any methane content (natural gas) is seen as a dangerous unwanted by-product.

- Fracking (for oil or gas) can also produce very high fugitive emissions.

- Fugitive emissions from LNG (natural gas, liquified for export) can increase the carbon footprint of imported gas by 50%.

Methane is easy to track on the ground, from the air and by satellite, but it's harder to assess leakage rates from any one source. Estimates range from 0.5% to over 10% of gas produced, depending upon the well. Typical values probably range between 1%-3.5%. In the worst cases, fugitive emissions could double the global warming footprint of the gas, oil or coal.

(leaks), which in some cases, could double these global warming footprints.

Hydrogen to store energy

The grid needs dispatchable energy to fill the gaps when renewables fade

At the moment, when the grid needs more power, it simply brings more gas power stations online. However, natural gas is expensive. The grid can also use batteries and pumped storage hydro, but these can only cover a few hours of power at most. For long periods of weak winds and solar, the only other

viable

Other dispatchable sources of electricity

Batteries - very efficient for short periods, but far too costly to store enough energy for more than a few hours.

Pumped storage hydro - same problem as batteries.

Interconnectors - imported power accounts for a significant share of UK electricity, but could fail if dark windless conditions stifled renewables across the whole of Europe for an extended period.

Nuclear or tidal power - these are not 'dispatchable', as they can't be switched on and off as required.

Demand-side response - not realistic for longer periods over a few hours.

Thermal storage - experimental technology has many hurdles to overcome.

alternative seems to be hydrogen, produced from spare electricity when renewables generate too much.

Only hydrogen can deliver 100 TWh of energy affordably

UK electricity demand currently peaks around 50GW, but this could double if heat pumps replace domestic gas boilers, along with requirements of electric cars and data centres. The grid needs a dispatchable power source that could supply 100GW for (say) two weeks - that’s 34 TWh. With batteries at £100/kWh, this would cost £34,000 billion. But if hydrogen can be made cheaply, underground storage could cost just a

few £billion

£2 Billion to build a 200 Bcf (17TWH) hydrogen storage facility

Centrica announced plans in 2024 to convert its Rough gas field storage facility to store hydrogen, and to quadruple its capacity to 200 billion cu.ft.. The upgrade, costing around £2 Billion, will include replacing the existing Rough Alpha platform with a new hydrogen-ready facility. There are many other massive depleted North Sea gas fields that could similarly be converted.

Smaller hydrogen stores are also being built in salt caverns, such as Northwich (1TWh), and Aldborough (320GWh)

.

Where would cheap hydrogen come from?

Wind turbines rarely achieve their maximum output, so the grid will build more capacity than the level of supply it actually needs. That will lead to situations when there is too much power, when the grid has to pay either for turbines to be disconnected ('curtailed'), or for someone else to use the spare electricity. And that's where electrolysis comes in - to use that excess electricity to make hydrogen at very low cost, that can be stored away for later.

If electrolysers cost just £500k per megawatt, and can operate on free electricity for 50,000 hours, then the cost of making hydrogen could fall as low as £0.01 per kWh (29p/therm). At 1/3 of the price of natural gas, suddenly hydrogen becomes the fuel of choice to generate electricity when there's no wind.

The economics of hydrogen

Electrolytic hydrogen cost has to compete with fossil fuel alternatives to survive

Any dreams of a 'hydrogen economy' will be dead in the water unless hydrogen can match the cost of natural gas, of

£1/therm

No market for hydrogen above £1/kg (or $0.50 in the US)

Natural gas trades around

£1/therm* in the UK, Europe and Far East Asia where gas is

scarce. In contrast, it is

much cheaper in gas-rich regions of the USA ($0.50/therm), and even less in the Middle East.

* 1 therm (29 kWh) is roughly the energy content of 1kg of hydrogen (33 kWh).

Plans to use hydrogen are unrealistic unless it can match the low price of natural gas, around £1/therm (i.e., £1/kg hydrogen)

,

or roughly £1/kg of hydrogen. In cheaper gas markets (eg USA or Middle East) it could be below $0.50.

The only possible way to make hydrogen cheaper than natural gas is by electrolysis

‘Grey’ and ‘blue’ hydrogen inherently cost more than the natural gas they’re made from. Any 'white' (naturally occurring) hydrogen will cost more than natural gas to extract. So that just leaves 'green' ... electrolysis. The £1/kg target presents a formidable challenge, as electricity costs today are much higher than natural gas per kWh, in addition to the cost of electrolyser machinery.

Future costs of hydrogen

Source | Power price

£/MWh | Power costs

£/kg H2

Electricity price (£ per kg of hydrogen)

= Electricity price (£ per MWh) / hydrogen output* (kg per MWh)

* PEM electrolyser stack output typically around 18kg of hydrogen per MWh

of electricity. This ignores any additional energy for other plant equipment (cooling, pumps, water purification, etc), or value of heat sold or oxygen sold.

|

Plant costs

£/kg H2

SMR plants cost around £0.70/kg H2 in the UK

(€ 0.81), which includes a £0.40 carbon levy.

Ballpark estimate . . .

Electrolyser plants to cost £0.50/ kg H2 by 2030

Capital costs of electrolysis include electrolyser stacks, compression to 3,000 PSI (to inject into geological gas storage) balancing plant, water supply purification, construction, and the cost of finance.

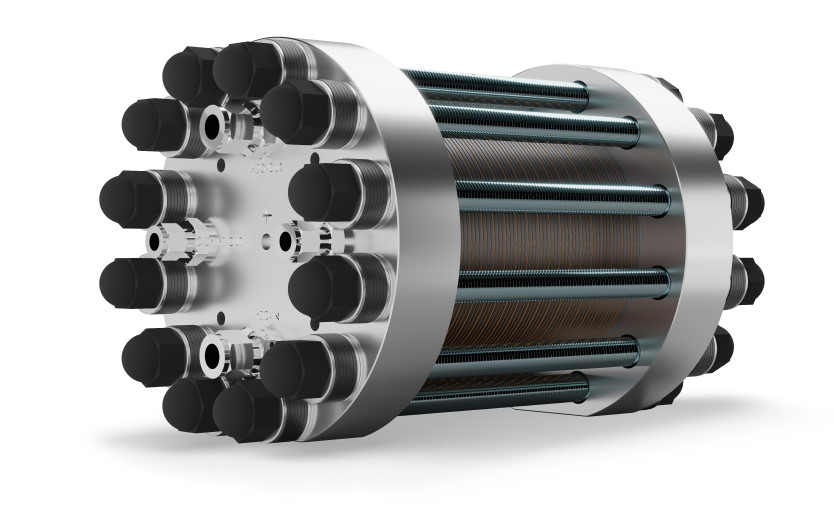

Manufacturers expect cost of PEM* electrolyser stack

to fall to around £500k/MW by 2030. These can produce nearly 20kg H2/MWh for 100,000 hours - 2 million kg of hydrogen in total.

All the additional equipment, facilities and finance could easily cost the same again, so £1 million, divided by 2 million kg . . . gives

electrolyser plant cost of £0.50 per kg H2

* We choose PEM electolysers because they use less power than cheaper alkaline electolysers, but can be start and stop quickly (unlike more-efficient SOE electolysers), so are better suited to intermittent use with renewables.

|

Total cost

£/kg H2 |

| H2 from fossil-fuel (UK) |

n/a

In the UK gas and electricity

wholesale markets:

Natural gas averages around £34/MWh (£1/therm)

Electricity averages around £87/MWh

* 1 therm of natural gas (methane) weighs roughly 2kg

* SMR consumes

3.16kg methane per kg hydrogen, worth roughly £1.60

* Natural gas trades around

$0.30/therm in USA (£8/MWh)

|

£1.60/kg | £0.70 | £2.30 /kg |

| H2 from fossil-fuel (USA) |

n/a

In US markets, natural gas trades around

$3/MMBTU (£8/MWh)

* 1 MMBTU = 10 therms

* 1 MMBTU of natural gas (methane) weighs roughly 20kg

* SMR consumes

3.16kg methane per kg hydrogen, worth roughly $0.50

*

|

$0.50/kg | $1.00 | $1.50 /kg |

| UK Grid electricity |

£ 85/MWh

In the UK gas and electricity

wholesale markets:

Natural gas averages around £34/MWh (£1/therm)

Electricity averages around £87/MWh

|

£4.25/kg | £0.50 | £4.75 /kg |

| UK Solar H2 (2030) |

£ 36/MWh

Onshore wind and solar power could be as low as

£36/MWh by 2030.

Note - these estimates may be optimistic, after 2024 CfD auctions using these projections failed to attract bidders.

|

£1.93/kg | £0.50 | £2.43 /kg |

| UK Curtailment H2 |

£ 12/MWh

Curtailed electricity - £0/MWh and below - when prices turn negative

Market prices actually fluctuate, so electricity price can go very high, or fall well below average for a period, and even

become negative when there is too much power on the grid. Negative prices mean that users get paid to use electricity during those periods, or producers paid to switch off (curtail) their output.

Electrolysis is an ideal way to soak up unwanted/curtailed electricity. Hydrogen could become commercially viable around £1.20/kg*. If plant costs £0.50/kg, then power costs can’t exceed £0.70/kg, or £12.60/MWh

*The price at which hydrogen matches natural gas UK 2024-5 price of 3p/kWh (or £8.30 per GJ).

1 GJ of hydrogen = 7kg, so the price (per kg) at which hydrogen becomes viable is £1.20/kg

| £1.80/kg | £0.50 |

£1.20 /kg

£1.20 is the price at which hydrogen becomes commercially viable

£1.20/kg = £3p/kWh, which is the 2024-5 UK/European average price of natural gas that hydrogen must compete with.

Supply of free curtailed energy will be very limited

Curtailed energy is cheap because nobody wants it. Consider these scenarios:

(1) The grid has 10 GW of surplus energy 20% of the time, and 10 GW of electrolysers connected. The electrolysers are running at 20% 'load factor'.

(2) When there's less than 10GW of surplus power, some units lie idle, not earning revenue.

(3) Building more renewables makes electrolysers more productive, but electrolysis alone doesn't cover the costs (of at least £37/MWh for solar). The renewables must be paid for by electricity demand.

Some electrolysers will get more curtailed energy (be more productive/profitable) than others. Productive plants will pay more for energy, whilst those on standby group will pay the price in lost revenues

|

Hierarchy of hydrogen uses

The possible uses for hydrogen far exceed what will ever be available

Hydrogen has been proposed as a potential replacement for almost every situation where fossil fuels generate emissions. However, such quantities of hydrogen are inconceivable on cost grounds.

Instead, we will have to be selective in how we use hydrogen: there will be a pecking order. So how do we choose?

Power-to-hydrogen-to-power - Using my grid model, I estimate that the cheapest dispatchable power will come from 100TWh of hydrogen made from up to 70GW of surplus electricity, powering 70GW of gas turbines, despite the very low efficiency compared to other storage.

Steel & cement manufacture - Both of these notoriously polluting industries might be

decarbonisable

Decarbonising steel

Blast furnaces use coal to make (a lot of heat and) carbon monoxide that can rip oxygen out of rust to make carbon dioxide and iron. Hydrogen could do the same thing in theory... but nobody has tried it at scale yet.

Decarbonising cement

Similar to the steel industry, cement manufacture is one of the biggest industrial sources of carbon emissions. Again the emissions stem partly from the need for very high temperature heat, and partly an inherent chemical reaction by-product. Hydrogen might be one pathway to clean cement.

using hydrogen.

Oil refining - Currently the number one use of hydrogen is to turn constituents of crude oil into fuel grade hydrocarbons. Hopefully the need for fuel oils will fall steeply in the coming years.

Chemicals industry - Hydrogen is a very common ingredient in chemical reactions used to manufacture plastics, pharmaceuticals, paints, adhesives, detergents, and many other chemicals.

Fertiliser - hydrogen is a precursor to ammonia used to make fertiliser (and explosives). Over-use of fertiliser degrades soil, pollutes waterways, and causes harmful NOX emissions. Some

researchers

estimate that fertiliser accounts for 5% of the world's greenhouse gas emissions, that could be cut to 1% without loss of productivity, with clean manufacture and improved farming practices regarding over-use.

Glass - Another building material with a high carbon footprint. The high temperatures of glass manufacture may need hydrogen to decarbonise.

Shipping - Hydrogen could possibly be used to make fuels for shipping, but it it unlikely to compete on cost with fossil fuels used for ships today, so may never be viable.

Aviation - similar to shipping.

See inset section 'hydrogen for shipping and aviation'

Road transport - hydrogen has already lost the race to decarbonise road transport, to battery electric vehicles, which are much cheaper, simpler, more efficient, and better-performing.

Domestic heating - Converting electricity to hydrogen to heat homes wastes 50% of the energy. Far better to use a heat pump, that triples the energy, so is

six times more efficient than a hydrogen boiler.

The Hydrogen Future

Cheap hydrogen will be limited to energy storage for electricity generation

Hydrogen from surplus electricity will be cheap, but limited in supply. After that, hydrogen will have to be made from full-price electricity, which will likely cost more than natural gas.

The grid has to build much more

renewables capacity

The grid will need to over-build renewable capacity

Wind and solar rarely work at capacity (full power): offshore wind output averages around 45% of maximum, whilst solar, over days, nights, years, produces an average of just 11.5% of its peak output. So there is every reason to build much more capacity than the expected demand.

As a result, on days when wind or solar is particularly strong, they will produce too much electricity. The grid has to pay either to reduce production (lay turbines off), or increase demand (find a use for it).

than it needs at any moment, because renewables never actually work at 100% output. Offshore wind averages around 45% of its rated output, so the output for a 10MW will vary between 0-10MW, but average 4.5MW over time. For solar (in the UK), with day and night, clouds and seasons, the figure is 11.5% of its rated output. . When cheap wind (at say £50/MWh) is low, the grid needs to burn gas (at £110/MWh) to make up the difference. So the grid can save £60/MWh by building more capacity.

However, when the wind picks up, now there’s too much electricity, and the unwanted surplus still costs its full price, so now the grid loses £50/MWh, unless it can find an alternative buyer for the surplus. That’s where storage comes in. The grid sells its excess electricity to storage providers, who make their money by selling it back to the grid when the wind drops. First, batteries or pumped hydro will buy it, but when they are full, only hydrogen can keep storing away more and more energy.

Selling electricity for hydrogen production reduces the losses from producing too much electricity. The cheap electricity makes hydrogen that's cheaper than natural gas, so the grid can afford to use it to make electricity when there's no other source. This can tip the balance away from reliance on expensive natural gas to fill the gap, to producing spare electricity for later by building more renewables.

Vast hydrogen reservoirs made from free electricity, stored in depleted gas fields

Free surplus power can drive

electrolysers

The cost of all this hydrogen hardware?

My model estimates electricity demand will double from today, fluctuating from 50GW up to around 100GW peak demand,

as the UK switches from gas heating to electric heat pumps, along with power for electric cars and data centres. This could come from:

* Wind - 140GW (@45% capacity) = 63GW average

* Solar - 270GW (@11.5% capacity) = 31GW average

* Batteries - 1TWh to help smooth daily fluctuations - £20 billion

* Hydrogen - 100TWh stored in old gas fields - £10-£20 billion?

* Electrolysers - 70GW (£35 billion?) to capture surplus electricity

* Gas turbines (CCGT) - 70GW (£70 billion?) to generate electricity from hydrogen

Total cost of hydrogen hardware - around £110 billion - roughly what the UK spends on fossil fuels each year.

Electrolysers produce mostly in April & May, then a bit less during November-January, and a few small bursts during the summer months.

Gas turbines come online for periods of days mostly from September to February.

pumping billions of cubic feet of cheap hydrogen into storage in depleted gas fields. Then when wind and solar are low, the grid can fire up the old gas & steam turbines (CCGT) that used to run on natural gas, to generate electricity on demand, using the hydrogen from storage.

UK might need up to 100TWh of hydrogen storage to get through winters

Rough gas field (storage facility) will hold 200 billion cubic feet of hydrogen (16TWh), made from 5 million tonnes of highly purified water (2000 olympic swimming pools), and cost £2 billion to create.

Hydrogen for other applications might come from sunnier climates

The demand for hydrogen for oil refining will largely disappear, but demand for other applications such as fertiliser & chemicals will continue, possibly with new demand for steel and/or cement making. However, the cost of adding extra renewables and electrolysers to produce it could be reduced by moving production to a sunnier climate where solar panels can produce three times as much electricity.

Certainly if hydrogen-derived fuels ever displace fossil fuels for shipping and aviation, they are more likely to come from huge solar farms in deserts rather than from the UK.

LINKS to hydrogen resource pages

IEA - interactive map of over 2000 hydrogen projects worldwide

IEA - interactive map predicting cost of hydrogen in 2030

UK.gov - Hydrogen production costs - a 2021 assessment of technologies and future hydrogen production costs

IEA - comparison of emission intensities of different hydrogen sources

RW Howarth - How green is blue hydrogen?

IEA - alternative figs for standalone SMR plant

The whole process uses 50% more gas than the chemical process (steam methane reformation), and produces 50% more CO2.

- 50% higher.

The whole process uses 50% more gas than the chemical process (steam methane reformation), and produces 50% more CO2.

- 50% higher.

(2) CO then reacts with more steam to produce CO2 and more hydrogen

(2) CO then reacts with more steam to produce CO2 and more hydrogen